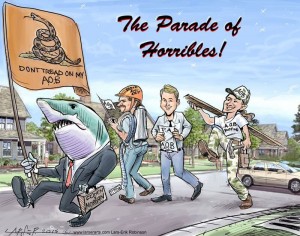

Just like when AOB abuse was rampant, the same abusers (The Parade of Horribles) are lining up again–this time to defeat desperately needed legislation that will stabilize Florida’s property market.

The parade has always been there, of course, with attorneys at the fore, guarding their treasure chests and characterizing their lawsuits as the result of insurers that “don’t pay their claims.”

Remember sinkholes and Sinkhole Alley? A new law passes (over their objection) and miraculously, no more sinkholes, no more alley. AOB, same thing.

Now there’s a new target, runaway lawsuits. SB-76 by Senator Jim Boyd (R-Bradenton) is another direct shot at yet another problem created by the same culprits. For sure there are other corrections needed long term, but… this bill pin points the prime issues right out of the gate. (See NOTE #1 below)

More will be known about its chances after the first airing in the Senate Banking and Insurance (B&I) Committee February 2nd. For what it’s worth, the committee Chairman and Co-Chairman are Senator Boyd and Senator Doug Broxson (R-Pensacola) respectively. Both are knowledgeable insurance agents quite adept at handling the technical aspects of the bill as well as the challenging political and parliamentary hurdles it will face. Senator Broxson championed the successful 2019 fight against AOB abuse opposed by the same players now lining up against SB-76.

Those lining up include the Cohen Law Group, whose head nicknamed himself the “Johnny Appleseed of AOB.” Cohen’s Action Alert urges “homeowners and business owners” to come to Tallahassee. And, for “every roofing company to bring a homeowner to the Tallahassee Civic Center on Tuesday February 2, 2021.”

A transparent plea at best– in 2015 one Cohen attorney filed 71 property suits. In 2020 that same attorney became the most prolific filer of property suits in Florida with 2,145…IN JUST 9 MONTHS! According to DFS records, that’s more than three times as many as Scot Strems.

And who would be surprised to learn that the Merlin Law Group is also mischaracterizing SB-76. Chip Merlin’s lawsuit mill is a salute to hypocrisy—pointing fingers at the alleged “bad faith” of insurers in the face of similar behavior within his own firm. (See NOTE #2 below)

But these are all distractions.

Merlin, Cohen, Strems et.al., don’t want you to look at the public data provided by actuaries, attorneys and experts at the OIR, the DFS, the ICA or at Citizens. They want you to ignore the revelations of the Strems disbarment proceedings (enter Collapse of an Evil Empire in the search bar) and available data showing a 400% explosion in lawsuits, 35% of which arrive before the insurer even knows there’s a loss.

Especially when unrefuted, facts are stubborn things. Insurers, while not perfect, are far from the culprits here and as usual it’s those fighting the hardest against the reforms that need to be reformed.

Florida’s Senate is on the right track.

##end##

NOTE #1: Among other things SB-76 solves the Attorney Fee Multiplier problem; provides for roof surface replacement schedules; reduces from 3 to 2 the number of years after a loss you can file a claim; requires notice of intent to file a suit; reforms the one-way attorney fee statute for all property suits similar to the changes for AOB; and much more. See SB-76 and watch the debate during the Senate B&I Committee at 3:30PM on February 2, on the Florida Channel.

NOTE #2: Search the name Merlin on this blog site. Merlin’s pleas against SB-76 contained mischaracterizations of a blog I posted years ago to demonstrate how a policyholder with a claim dispute does not need to hire a public adjuster or an attorney. I suggested policyholders seek free mediation from the state and cited how I used that approach to handle a claim dispute I had with an insurance company. Merlin implied that I was offering proof that the insurance industry needed “… Strong oversight and civil penalties to keep it in line”. That implication from Merlin’s blog is not true. I never uttered such a statement nor was that the purpose of my blog–a purpose he ignored because, once again, it was to his pecuniary benefit to do so. He also said I was a lobbyist which is not true and that I’m paid by insurers, also not true.

IMPORTANT: If you enjoyed this post you’re invited to subscribe for automatic notifications by going to: www.johnsonstrategiesllc.com. Enter your email address where indicated. If you’re already on the website at Johnson Strategies, LLC, go to the home page and enter your email address on the right-hand side. Remember, you’ll receive an email confirming your acceptance, so…check and clear your spam filter for notifications from Johnson Strategies, LLC. ENJOY!

Please view “The Johnson Strategies Story”

I think that SB76 will increase litigation. It does not define some important terms/concepts. But that’s easy to fix. Define:

“Inspection & Documentation”: Defined as being performed per accepted industry standards as well complying with all state and federal laws.

“Demand”: Means the specific amount alleged to be owed by the insurer to the claimant under the property insurance policy. Add: Must be calculated based on work performed per accepted industry standards and compliant with all state and federal laws.

“Pre-Suit Settlement Offer”: Means the offer made by the insurer in its written response to the notice of intent to initiate litigation. Offer must be for work that is compliant with industry standards and all State and Federal Laws.